Best Books on Moving Average Envelopes to Buy in February 2026

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER TECHNICAL ANALYSIS TO BOOST YOUR TRADING SKILLS!

- PREMIUM QUALITY MATERIAL FOR DURABILITY AND A GREAT READING EXPERIENCE.

- UNLOCK FINANCIAL MARKETS WITH EXPERT INSIGHTS AND STRATEGIES!

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

- PERFECT FOR AVID READERS SEEKING QUALITY LITERATURE.

- IDEAL GIFT CHOICE FOR BOOK LOVERS OF ALL AGES.

- ENGAGING CONTENT THAT ENHANCES ANY READING EXPERIENCE.

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

- WORK ANYWHERE: EMBRACE FREEDOM AS A GLOBAL DAY TRADER!

- BE YOUR OWN BOSS: SET YOUR OWN HOURS AND GOALS!

- SUCCESS REQUIRES TOOLS, MOTIVATION, AND DETERMINATION!

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

- PERFECT GIFT FOR BOOK LOVERS AND SPECIAL OCCASIONS!

- COMPACT DESIGN MAKES IT TRAVEL-FRIENDLY AND CONVENIENT!

- IDEAL FOR COZY READING MOMENTS AT HOME OR ON-THE-GO!

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game – written by a high-stake day trader

How to Day Trade: The Plain Truth

The Trader's Handbook: Winning habits and routines of successful traders

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.blogweb.me/1/41e_Ap_i_Cp_LL_SL_160_bca8fb37b5.jpg)

The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51_Jozc_NDI_6_L_SL_160_597c2872ce.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

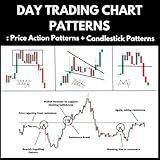

Day Trading Chart Patterns : Price Action Patterns + Candlestick Patterns

Moving Average Envelopes are a technical analysis tool used in trading to identify potential trends and support and resistance levels. They consist of two lines plotted above and below a moving average line. The upper line is typically drawn by plotting a certain percentage (usually 1% or 2%) above the moving average, while the lower line is plotted by subtracting the same percentage below the moving average.

The moving average line itself is calculated by averaging the closing prices of a specific period, such as 20 days or 50 days. It helps smoothen out price fluctuations and provides a more accurate representation of the underlying trend.

Interpreting the Moving Average Envelopes involves several considerations. First, when the price moves above the upper envelope line, it may indicate an overbought condition or a potential reversal to the downside. Conversely, when the price falls below the lower envelope line, it may suggest an oversold condition or a possible reversal to the upside.

Traders also use the width between the upper and lower envelope lines as an indicator of market volatility. If the width narrows, it may indicate a period of low volatility, hinting at a potential upcoming breakout. Conversely, a widening of the envelopes suggests increasing volatility.

Moving Average Envelopes can be combined with other technical indicators or chart patterns to strengthen trading signals. For example, if a price breakout occurs above the upper envelope line and is confirmed by a bullish candlestick pattern or a surge in trading volume, it may indicate a strong buy signal. Similarly, a price breakdown below the lower envelope line, confirmed by bearish candlestick patterns or high selling pressure, may be seen as a strong sell signal.

It is important to note that Moving Average Envelopes, like any other technical analysis tool, are not foolproof and should be used in conjunction with other forms of analysis. They are most effective when used in trending markets, as they provide valuable insights into potential support and resistance levels and overall market sentiment. Traders should also consider using appropriate risk management strategies and conducting thorough research before making any trading decisions.

How to identify potential support and resistance levels using Moving Average Envelopes?

To identify potential support and resistance levels using Moving Average Envelopes, follow these steps:

- Understand Moving Average Envelopes: Moving Average Envelopes consist of two lines plotted above and below a moving average line. The upper line is a certain percentage (e.g., 3%) above the moving average, while the lower line is the same percentage below the moving average.

- Determine the Moving Average: Choose a suitable moving average period based on your trading strategy. Common options include the 20-day, 50-day, or 200-day moving averages.

- Plot the Moving Average Envelopes: Add the moving average to your chart, and then add the upper and lower envelope lines, usually depicted as two parallel lines above and below the moving average.

- Observe Price Action: Study how the price interacts with the upper and lower envelope lines. The upper line represents a potential resistance level, while the lower line indicates a potential support level.

- Analyze Price Reactions: Pay attention to how the price behaves when it reaches the upper or lower envelope lines. If the price repeatedly bounces off the upper line, it suggests strong resistance. Conversely, if the price consistently finds support at the lower line, it indicates a robust support level.

- Confirm with Other Indicators: Use other technical indicators, such as candlestick patterns, trendlines, or volume analysis, to validate the potential support and resistance levels identified by the Moving Average Envelopes.

Remember that no indicator is foolproof, and it is essential to combine Moving Average Envelopes with other technical analysis tools to make more accurate trading decisions.

How to interpret the lower band of Moving Average Envelopes?

The lower band of Moving Average Envelopes is a technical indicator that is used in financial analysis to interpret price movements. It is derived from a moving average line, typically a simple moving average, with a specified percentage deviation.

Here are some ways to interpret the lower band of Moving Average Envelopes:

- Support Level: The lower band can act as a support level for the price. If the price touches or falls below the lower band, it may indicate a potential buying opportunity as the price may reverse and move upwards.

- Oversold Condition: When the price falls significantly below the lower band, it suggests that the market may be oversold, meaning that sellers have dominated and pushed the price lower than its normal range. Traders may interpret this as a signal to anticipate a price reversal or a potential buying opportunity.

- Trend Continuation: If the price consistently stays above the lower band during an uptrend, it may suggest that the prevailing trend is strong and likely to continue. Conversely, if the price remains below the lower band during a downtrend, it could indicate a continuation of the downward trend.

- Volatility Indicator: The width of the envelope between the upper and lower bands can indicate the volatility of the price. A narrower width suggests lower volatility, while a wider width suggests higher volatility. Traders often use this information to assess the potential risk and adjust their trading strategies accordingly.

It's important to note that Moving Average Envelopes should be used in conjunction with other technical indicators and analysis tools for better accuracy and confirmation. Additionally, it's always recommended to use the indicator in combination with other forms of analysis and risk management techniques to make more informed trading decisions.

What are the common mistakes to avoid when interpreting Moving Average Envelopes?

When interpreting Moving Average Envelopes, there are several common mistakes that should be avoided:

- Misunderstanding the envelope width: The width of the envelope is determined by a percentage above and below the moving average. It is essential to understand that the width is not fixed but expands and contracts with market volatility. Failing to acknowledge this could result in incorrect interpretations and trading decisions.

- Over-reliance on signals: Moving Average Envelopes are used to generate trading signals when the price breaks above or below the upper or lower band. However, solely relying on these signals without considering other technical indicators or fundamental analysis can lead to false positives and poor trading outcomes.

- Neglecting market context: Moving Average Envelopes work best in trending markets. In ranging or choppy markets, the price may frequently cross above and below the bands, resulting in misleading signals. Considering the broader market context can help avoid false interpretations and improve the performance of the indicator.

- Not using confirmation indicators: Moving Average Envelopes should be used in conjunction with other technical indicators or chart patterns to confirm signals. Utilizing additional indicators such as oscillators, volume analysis, or trendline breaks can provide added reliability and filter out false signals.

- Ignoring price action: It is crucial to pay attention to price action and the overall chart pattern when interpreting Moving Average Envelopes. If the price consistently fails to reach or break the upper or lower band, it may indicate a change in trend, support or resistance levels, or a weakening of the indicator's validity.

- Neglecting risk management: Like any indicator, Moving Average Envelopes can provide false signals or generate losses. It is essential to implement proper risk management techniques such as setting stop-loss orders, using appropriate position sizing, and incorporating risk-reward analysis to protect capital and mitigate potential losses.

By avoiding these common mistakes, traders can enhance their understanding and utilization of Moving Average Envelopes, improving the accuracy of their interpretations and trading decisions.

How to combine Moving Average Envelopes with other indicators?

Combining Moving Average Envelopes with other indicators can help to create more in-depth and reliable trading signals. Here are a few approaches you can consider:

- Trend Confirmation: Use a trend-confirming indicator, such as the MACD (Moving Average Convergence Divergence) or the ADX (Average Directional Index), along with Moving Average Envelopes. If the Moving Average Envelopes indicate an uptrend and the trend-confirming indicator also signals a bullish trend, it provides a stronger indication for a potential long trade.

- Oscillators: Combine Moving Average Envelopes with oscillators like the RSI (Relative Strength Index) or Stochastic Oscillator. This can help to identify overbought or oversold conditions within the envelope bands. For example, if the price reaches the upper band of the Moving Average Envelopes and the oscillator shows overbought conditions, it might suggest a possible reversal or a short trade opportunity.

- Volume Analysis: Incorporating volume analysis indicators, such as On-Balance Volume (OBV) or Volume Weighted Average Price (VWAP), can enhance the analysis. Comparing the volume trend with the movement of price relative to the envelope bands can provide additional confirmation of trend strength or potential reversals.

- Candlestick Patterns: Combine Moving Average Envelopes with candlestick patterns, such as doji, engulfing, or hammer formations. Identifying candlestick patterns near the envelope bands can improve the reliability of trade signals, especially when they coincide with other indicators.

Remember, it's essential to test and validate any combination of indicators using historical data or in a demo trading environment before implementing it in live trading. Additionally, it's crucial to understand the strengths and limitations of each indicator to make informed trading decisions.

What are the common trading strategies involving Moving Average Envelopes?

There are several common trading strategies involving Moving Average Envelopes. Here are a few examples:

- Breakout Strategy: Traders use moving average envelopes to identify breakouts when the price crosses above or below the upper or lower envelope. A bullish breakout occurs when the price moves above the upper envelope, indicating a potential upward trend. Conversely, a bearish breakout occurs when the price drops below the lower envelope, indicating a potential downward trend. Traders may enter buy or sell positions accordingly.

- Mean Reversion Strategy: This strategy assumes that prices tend to revert to their mean value after deviating too far from it. Traders use moving average envelopes to identify overbought and oversold conditions. When the price reaches the upper envelope, it is considered overbought, indicating a potential reversal to the downside. Conversely, when the price reaches the lower envelope, it is considered oversold, indicating a potential reversal to the upside.

- Trend Confirmation Strategy: Traders use moving average envelopes to confirm the direction of the underlying trend. When the price stays consistently above the moving average envelope, it suggests an uptrend. Conversely, if the price remains consistently below the moving average envelope, it suggests a downtrend. Traders may then look for other technical indicators or price patterns to time their entries or exits within the prevailing trend.

- Swing Trading Strategy: Traders use moving average envelopes to identify swing trading opportunities. They buy when the price touches or bounces off the lower envelope and sell when the price touches or bounces off the upper envelope. This strategy aims to capture short to medium-term price swings within the envelope boundaries.

Remember, these trading strategies should be used in conjunction with other technical analysis tools and indicators to increase the probability of successful trades. It is also recommended to test these strategies using historical data or in a demo trading environment before applying them with real money.