Best Stock Market Chart Tools to Buy in February 2026

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

- MASTER TRADING WITH 20 CHART PATTERNS & 34 CANDLESTICK DESIGNS.

- BUILD CONFIDENCE FOR PROFITABLE TRADES WITH PRACTICAL EXAMPLES.

- DURABLE, PORTABLE CARDS PERFECT FOR ON-THE-GO LEARNING!

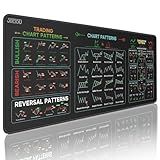

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,X-Large Computer Mouse Pad/Desk Mat with Stitched Edges 31.5 x 11.8 in

-

UNIQUE DESIGN: STOCK WIN THEME INSPIRES LUCK AND GUIDANCE FOR TRADERS.

-

COMPREHENSIVE CHARTS: ORGANIZED TRADING TOOLS FOR BEGINNERS AND DAY TRADERS.

-

DURABLE QUALITY: NON-SLIP, WEAR-RESISTANT SURFACE FOR LONG-LASTING USE.

12Pcs Trading Chart Pattern Posters Candlestick Pattern Poster Bulletin Board Crypto and Stock Market Trading Poster Office Decorations for Trader Investor Supplies Wall Door Decor 11 x 15.7 Inches

- COMPREHENSIVE TRADING TOOLKIT WITH 12 POSTERS & 100 ADHESIVE DOTS.

- EXQUISITE, PROFESSIONAL DESIGN ENHANCES YOUR TRADING WORKSPACE.

- DURABLE, LAMINATED QUALITY ENSURES LONGEVITY AND EASY CLEANING.

Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet, Large Computer Mouse Pad for Home Office, Desk Mat with Stitched Edges 800x300mm*3mm Thickness

- LARGE SURFACE: 800X300MM FOR SMOOTH OPERATION AND AMPLE WORKSPACE.

- DURABLE MATERIAL: SOFT TEXTURE ENSURES PRECISE MOVEMENTS FOR LONG USE.

- TRADER'S TOOL: IDEAL FOR ANALYZING TRENDS WITH CLEAR PRINTED CONTENT.

Candlestick Pattern Cheat Sheet for Trading – 3-Page Durable Cardstock with 190+ Chart Patterns – Includes Candlestick and Traditional Technical Analysis for Stock, Crypto, and Forex Traders

- ACCESS 190+ PATTERNS FOR QUICK RECOGNITION AND PROFITABLE SETUPS.

- ENHANCE TRADING DECISIONS WITH PROVEN HISTORICAL PRICE PATTERNS.

- DURABLE, PORTABLE DESIGN FOR TRADERS-PERFECT FOR ANY MARKET.

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet, Standard Computer Mouse Pad/Desk Mat with Stitched Edges Black 10.2x8.3 inch

-

INSPIRE SUCCESS: UNIQUE DESIGN SYMBOLIZES STOCK MARKET LUCK AND GUIDANCE.

-

SMART TRADING TOOL: ORGANIZED CHARTS AND INDICATORS FOR SWIFT TRADING DECISIONS.

-

DURABLE & NON-SLIP: QUALITY MATERIALS ENSURE A STABLE, LONG-LASTING INVESTMENT.

Reading stock market charts is an essential skill for anyone interested in investing or trading in the stock market. The charts provide valuable information about the historical performance of a stock, allowing investors to make informed decisions regarding buying or selling stocks.

When reading stock market charts, it is essential to understand the key components and indicators present in the chart. Here are some important factors to consider:

- Time Frame: Stock market charts display data over specific timeframes, such as daily, weekly, monthly, or even intraday. The time frame chosen will affect the level of detail visible in the chart.

- Price Axis: The vertical axis of the chart represents the stock price. The scale used might be linear or logarithmic, depending on the chart type. A linear scale shows price movement in equal increments, while a logarithmic scale displays percentage changes.

- Time Axis: The horizontal axis represents the time period of the chart. It could display specific dates or intervals, such as minutes, hours, days, weeks, or months, depending on the chosen time frame.

- Candlestick or Line Charts: There are different types of charts available, but the most commonly used are candlestick and line charts. Candlestick charts provide more detailed information about the stock's price movement, while line charts show a simplified view of the stock's closing prices.

- Volume: Stock market charts often include a volume chart or histogram, which displays the trading volume during specific periods. High trading volume can indicate increased investor interest or significant price movement.

- Trendlines: Trendlines are diagonal lines drawn on the chart to represent the stock's upward or downward trend. They help identify the overall direction in which the stock is moving.

- Support and Resistance Levels: These levels are horizontal lines drawn on the chart to indicate price levels at which a stock has historically found support (buying interest) or resistance (selling pressure). They can provide insights into potential buying or selling opportunities.

- Indicators: Various technical indicators, such as moving averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and others, can be added to stock market charts to provide additional insight into the stock's price movement.

Reading stock market charts involves analyzing these components collectively to gain a comprehensive understanding of a stock's historical performance. It helps investors identify patterns, trends, and potential support and resistance levels, which can guide their investment decisions. However, it's important to note that chart reading is just one aspect of stock analysis, and it should be combined with fundamental analysis and other factors before making any investment decisions.

What is relative strength index (RSI) in stock market analysis?

Relative Strength Index (RSI) is a technical analysis indicator used in stock market analysis to measure the speed and change of price movements of a particular stock or market. It is a momentum oscillator that ranges from 0 to 100.

The RSI calculates the strength or weakness of a stock by comparing the magnitude of recent gains and losses over a specified period. It is primarily used to identify overbought or oversold conditions in a stock, indicating potential buying or selling opportunities.

When the RSI is above 70, it suggests that the stock is overbought, meaning it may be due for a price correction or pullback. Conversely, when the RSI is below 30, it indicates the stock is oversold, suggesting that it may be undervalued and due for a potential price rebound.

Traders and investors can use the RSI to generate buy or sell signals, or to confirm trends and price patterns observed in the stock. It is important to note that the RSI is one of many tools or indicators used in stock market analysis and should not be solely relied upon for decision-making.

How to identify support-turned-resistance and resistance-turned-support levels in stock market charts?

Identifying support-turned-resistance and resistance-turned-support levels in stock market charts involves analyzing the price movement of a stock over a period of time. Here are some steps you can follow to identify these levels:

- Plot the stock's price chart: Use a charting platform or software to plot the historical price movement of the stock. Choose a timeframe that suits your analysis (e.g., daily, weekly, or monthly).

- Look for support and resistance levels: Identify significant price levels where the stock has historically shown support or faced resistance. Support levels are where the price has previously stopped falling and rebounded, while resistance levels are where the price has previously stopped rising and reversed downwards.

- Observe price action around these levels: Once you have identified potential support and resistance levels, observe how the price reacts to these levels in subsequent price movements. A support level that has been breached by the price can turn into resistance, and a resistance level that has been broken can turn into support.

- Volume and price patterns: Analyze the volume and price patterns around these levels. Significant increases in trading volume coupled with price reversals can indicate the strength of a support-turned-resistance or resistance-turned-support level.

- Confirmation: Look for multiple instances where the price respects a specific level. The more times the price reacts to a level, the stronger the level becomes. This can help confirm the validity of support-turned-resistance or resistance-turned-support levels.

- Trendlines and moving averages: Use trendlines or moving averages to further validate these levels. Trendlines can help identify the overall trend in the stock price, while moving averages can provide additional confirmation of support or resistance levels.

- Test the level: Once you have identified a potential support-turned-resistance or resistance-turned-support level, monitor how the price reacts when it approaches that level again. If the level holds and the price bounces off, it further confirms its significance.

Remember that support and resistance levels are not always precise, and the stock price can sometimes break through these levels temporarily before reversing. As with any technical analysis technique, it's important to combine different indicators and use your judgment to make informed investment decisions.

What is the importance of risk management in stock market trading based on charts?

Risk management is crucial in stock market trading based on charts for several reasons:

- Preservation of Capital: Risk management helps protect traders' capital by limiting potential losses. By setting stop-loss orders based on chart patterns, traders can exit positions if the price goes against them, minimizing losses and preserving capital for future trades.

- Trade Size Management: Effective risk management involves determining the appropriate trade size based on the chart patterns and risk-reward ratios. Traders can adjust the position size based on the stop-loss levels and overall risk tolerance, ensuring they do not overexpose themselves to any single trade.

- Emotion Control: Charts provide objective information about price movements, helping traders make decisions based on technical analysis rather than emotions. Risk management strategies, such as setting predetermined profit targets and stop-loss levels based on chart patterns, reduce emotional decision-making and foster disciplined trading.

- Consistency and Longevity: Implementing risk management techniques helps traders maintain consistency in their trading strategies over time. By controlling risk, traders can avoid large drawdowns or catastrophic losses that could potentially wipe out their trading capital. Consistent risk management is essential for traders to stay in the market for the long term and achieve sustainable profitability.

- Improving Risk-Reward Ratio: Charts provide insights into potential price targets and support/resistance levels, which allow traders to assess the risk-reward ratio of a trade. By identifying chart patterns that offer higher potential rewards relative to the assigned risk, traders can find more favorable trading opportunities and increase their overall profitability.

- Adaptability to Changing Market Conditions: Charts provide traders with visual representations of market trends and price movements. By analyzing charts, traders can identify changing market conditions, such as reversals, breakouts, or consolidations, which require adjustments in their risk management strategies. This adaptability helps traders navigate various market environments and reduces the likelihood of large losses during unpredictable market fluctuations.

In summary, risk management in stock market trading based on charts is vital for preserving capital, controlling emotions, maintaining consistency, improving risk-reward ratios, and adapting to changing market conditions. By effectively managing risk, traders enhance their chances of long-term success and profitability in the stock market.