Best Stock Market Analysis Tools to Buy in February 2026

Candlestick Pattern Cheat Sheet for Trading – 3-Page Durable Cardstock with 190+ Chart Patterns – Includes Candlestick and Traditional Technical Analysis for Stock, Crypto, and Forex Traders

-

ACCESS 190+ PATTERNS FOR RAPID MASTERY OF TECHNICAL ANALYSIS.

-

ENHANCE BUY/SELL DECISIONS WITH PROVEN HISTORICAL TRADING PATTERNS.

-

DURABLE, PORTABLE DESIGN FOR TRADERS OF ALL EXPERIENCE LEVELS.

Charting and Technical Analysis

- MASTER STOCK TRENDS WITH ADVANCED CHARTING AND ANALYSIS TOOLS.

- ENHANCE INVESTMENT DECISIONS USING PRECISE TECHNICAL ANALYSIS.

- UNLOCK STOCK MARKET INSIGHTS TO BOOST YOUR TRADING STRATEGIES.

A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today

How to Make Money in Any Market

The AutoStory Stock Market Trading Flashcards | 72 Trading Candlestick Flashcards | Financial Literacy Tool

-

MASTER TRADING CONCEPTS QUICKLY WITH OUR EXPERT-DEVELOPED FLASHCARDS!

-

COMPACT SIZE ALLOWS LEARNING ANYTIME-PERFECT FOR BUSY SCHEDULES!

-

IDEAL GIFT FOR TRADERS: BLEND EDUCATION AND FUN IN ONE UNIQUE PACKAGE!

How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing Book 1)

Technical Analysis Trading Posters Set – 11 Stock Market Chart Pattern Cheat Sheets for Traders | Candlestick Patterns, Forex & Crypto Wall Art | Price Action, Risk Reward, Divergence, Retest & Strategy Guide

-

BOOST YOUR TRADING WITH 11 VISUAL CHEAT SHEETS FOR QUICK ANALYSIS.

-

MASTER ENTRY/EXIT TIMING WITH ADVANCED CANDLESTICK AND PATTERN GUIDES.

-

STRUCTURE TRADES WITH RISK-REWARD GRIDS FOR SMARTER DECISION-MAKING.

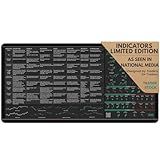

Limited Edition Trader’s Desk Mat - Stock Market Mouse Pad with Key Indicators - Large Size with Candlestick Chart Patterns - Gifts for Traders

- PROFESSIONAL TRADING TOOL FOR SERIOUS MARKET ANALYSIS

- DURABLE, EXTRA-THICK DESIGN FOR EXTENDED TRADING COMFORT

- COMPLETE INDICATOR SYSTEM FOR IN-DEPTH MARKET INSIGHTS

Filtered Waves, Basic Theory: A Tool for Stock Market Analysis

The Arms Index, also known as the TRading INdex (TRIN), is a technical analysis tool used by traders and investors to measure the strength and direction of a market. It was developed by Richard Arms in the 1960s.

The Arms Index measures market breadth, which refers to the underlying strength or weakness of a market. It helps traders assess whether a market is overbought or oversold by analyzing the relationship between advancing and declining stocks and volume.

The calculation of the Arms Index involves dividing the ratio of advancing stocks to declining stocks by the ratio of advancing volume to declining volume. The formula is as follows:

TRIN = (Number of advancing stocks / Number of declining stocks) / (Volume of advancing stocks / Volume of declining stocks)

Typically, the resulting TRIN value is analyzed using a 10-day simple moving average to smooth out any daily fluctuations. TRIN values above 1 are considered bearish, indicating that more volume is flowing into declining stocks compared to advancing stocks. This suggests a potential oversold market condition. On the other hand, TRIN values below 1 are considered bullish, indicating that more volume is flowing into advancing stocks compared to declining stocks, suggesting a potential overbought market condition.

The Arms Index is particularly useful in identifying short-term market reversals. When the TRIN reaches extreme levels, such as above 2.0 or below 0.6, it can indicate a highly oversold or overbought condition, respectively. These extreme readings may imply that a market correction or a reversal is imminent.

Traders often use the Arms Index in conjunction with other technical indicators to confirm their trading decisions. It helps identify potential entry and exit points, as a highly oversold or overbought market can precede a reversal in trend.

However, it's important to note that the Arms Index is not a standalone indicator for making trading decisions. It should be used in conjunction with other technical analysis tools and indicators for a comprehensive market analysis. Additionally, like any other technical analysis tool, the Arms Index is not infallible and should be used with caution.

Overall, the Arms Index (TRIN) provides traders and investors with a quantitative tool to assess market strength and potential reversals. Its interpretation can aid in timing trades and identifying potential market trends.

What are the common misconceptions about the Arms Index (TRIN)?

There are a few common misconceptions about the Arms Index (TRIN):

- The Arms Index predicts the future market direction: One misconception is that the Arms Index can predict the future direction of the market. However, the TRIN is primarily a short-term measure of market breadth and investor sentiment rather than a predictive indicator. It provides insight into the market's internal dynamics and can help traders gauge the intensity of buying or selling pressure, but it should not be solely relied upon for making trading decisions.

- A high TRIN value always indicates selling pressure: Another misconception is that a high TRIN value always signifies strong selling pressure. While a high TRIN value generally suggests a higher volume of selling relative to buying, it is essential to consider market context and other technical indicators. For instance, if the market is experiencing a significant uptrend, a high TRIN value might indicate profit-taking rather than a shift to bearish sentiment.

- A low TRIN value always indicates buying pressure: Similarly, a common misconception is that a low TRIN value always indicates buying pressure and a bullish market. While a low TRIN value generally suggests higher buying relative to selling, it doesn't necessarily mean the market is poised for an immediate bullish move. Market participants need to consider other indicators and factors to make well-rounded trading decisions.

- TRIN is the be-all and end-all measure of market breadth: Some traders may mistakenly assume that the Arms Index is the comprehensive measure of market breadth and can single-handedly offer a complete picture of the market's internal health. However, the TRIN is just one tool among many in a trader's toolkit to assess market conditions. It is important to use TRIN in conjunction with other technical indicators, chart patterns, and fundamental analysis to make more informed decisions.

- The TRIN is always accurate: While the TRIN can provide valuable insights into market dynamics, it is not infallible. It is based on volume and advance-decline data, which may have inherent limitations and noise. Additionally, extreme market conditions or unusual trading patterns can sometimes distort the TRIN readings, leading to potential false signals. Traders should always exercise caution and validate TRIN readings with multiple indicators and analysis methods.

How can the Arms Index (TRIN) help identify opportunities for short-term trading?

The Arms Index or TRading INdex (TRIN) is a technical analysis indicator that can provide insights into short-term trading opportunities by measuring the relationship between market volume and the ratio of advancing and declining stocks.

Here's how the Arms Index can help identify short-term trading opportunities:

- Overbought and oversold conditions: The Arms Index calculates a ratio of advancing and declining stocks relative to the advancing and declining volume. When the Arms Index is below 1, it suggests that more volume is going into advancing stocks, indicating a potentially overbought condition. Conversely, when the Arms Index is above 1, it suggests more volume going into declining stocks, indicating a potentially oversold condition. These extremes can signal short-term reversal opportunities.

- Divergences: By comparing the Arms Index with the price movement of a stock or an index, traders can identify divergences that may indicate a potential trend reversal. For example, if the market is rising but the Arms Index is also rising, it suggests that the volume is not supporting the upward trend, indicating a potential trend reversal.

- Confirmation of trend: When the Arms Index confirms the direction of the prevailing trend, it can provide reassurance to traders. For example, during an uptrend, if the Arms Index remains consistently below 1, it suggests that the upward momentum is supported by strong volume. This confirmation can be used as a signal to continue holding or adding to long positions.

- Market breadth analysis: The Arms Index measures the market breadth by considering the number of advancing and declining stocks and their associated volume. Traders can use this information to assess the overall health of the market. If the Arms Index is consistently above 1 for an extended period, it suggests weak market breadth, indicating market weakness and potentially pointing to short-term trading opportunities on the short side.

- Short-term volatility and reversals: The Arms Index can also help identify short-term volatility and potential trend reversals. Rapid spikes in the Arms Index can indicate panic selling or buying, leading to short-term market reversals. Traders can watch for extreme readings in the Arms Index, such as a sudden surge above 2 or drop below 0.5, as potential entry or exit points for short-term trades.

It's important to note that no indicator is foolproof, and traders should use the Arms Index in conjunction with other technical analysis tools and market information for a comprehensive analysis. Additionally, it's advisable to backtest and validate any strategies based on the Arms Index before implementing them in real-time trading.

How to build a trading strategy based on the signals from the Arms Index (TRIN)?

Building a trading strategy based on signals from the Arms Index (also known as the TRIN or Trading Index) involves analyzing the indicator in combination with other technical analysis tools. The Arms Index is a breadth indicator that measures the ratio of advancing stocks to declining stocks, as well as the ratio of advancing volume to declining volume.

Here are the steps to build a trading strategy using the Arms Index (TRIN):

- Calculation of the Arms Index (TRIN): Calculate the advancing and declining issues (stocks) for a given time period (e.g., 1 hour, daily, weekly). Calculate the advancing and declining volume for the same time period. Divide the ratio of advancing stocks to declining stocks by the ratio of advancing volume to declining volume to get the Arms Index (TRIN).

- Understanding the Arms Index signals: A TRIN below 1 indicates positive market breadth, suggesting bullish sentiment. A TRIN above 1 indicates negative market breadth, suggesting bearish sentiment. Extreme values of TRIN (below 0.7 or above 1.3) often indicate oversold or overbought conditions respectively.

- Confirming signals with other technical analysis tools: Use other technical indicators such as moving averages, trendlines, or oscillators to confirm the signals generated by the Arms Index. For example, if the Arms Index shows a bearish signal (TRIN above 1), check whether other indicators are also indicating a potential market downturn, such as a bearish moving average crossover or a break of a significant trendline.

- Developing a trading strategy: Determine the specific entry and exit criteria for your trades based on the Arms Index signals and confirmation from other technical tools. For example, if the Arms Index shows a bullish signal (TRIN below 1) and is confirmed by other indicators, you may consider entering long positions. Consider setting stop-loss orders to manage risk and protect against unexpected market movements.

- Backtesting and refining the strategy: Test the trading strategy on historical data to assess its performance and profitability. Make adjustments and refinements to optimize the strategy, such as altering the parameters or adding additional indicators.

Remember that no trading strategy is foolproof, and it is crucial to continuously monitor and evaluate the effectiveness of your strategy. Additionally, consider using proper risk management techniques and consulting with a financial advisor before implementing any trading strategy.

What is the relationship between the Arms Index (TRIN) and market volatility?

The Arms Index, also known as the Traders' Index (TRIN), measures the relationship between advancing and declining stocks and the volume associated with these stocks. It is used to assess market sentiment and to gauge the intensity of buying and selling pressure in the market.

The Arms Index is calculated by dividing the ratio of advancing stocks to declining stocks by the ratio of advancing volume to declining volume. A value below 1 is considered bullish, indicating a higher volume in advancing stocks compared to declining stocks. Conversely, a value above 1 is considered bearish, suggesting higher volume in declining stocks compared to advancing stocks.

The relationship between the Arms Index (TRIN) and market volatility is inversely related. This means that as market volatility increases, the Arms Index tends to rise, indicating bearish sentiment and higher selling pressure in the market. Conversely, as market volatility decreases, the Arms Index tends to decrease, indicating bullish sentiment and higher buying pressure in the market.

Investors and traders use the Arms Index as a contrarian indicator. When the TRIN reaches extreme levels (very high or very low), it suggests that the market may be overbought or oversold, respectively. This can signal a potential reversal or a change in market direction. Therefore, monitoring the Arms Index can provide insights into market volatility and potential market reversals.

How to interpret the Arms Index (TRIN) in conjunction with volume analysis?

The Arms Index, also known as the TRIN (Trading Index), is a technical indicator used to gauge the strength or weakness of a stock market by measuring the relationship between advancing and declining issues and the volume associated with them. Interpreting the Arms Index in conjunction with volume analysis involves considering the following steps:

- Understanding the calculation: The Arms Index is calculated by dividing the advancing issues by the declining issues, and then dividing that by the advancing volume by the declining volume. This formula helps understand the ratio between market breadth (number of advancing and declining stocks) and market intensity (volume associated with the advancing and declining stocks).

- Analyzing market breadth: When the Arms Index is below 1, it suggests that the market is relatively bullish as there is more volume associated with advancing stocks compared to declining stocks. Conversely, when the Arms Index is above 1, it indicates bearishness in the market as declining stocks have more associated volume. The further away from 1, the stronger the bullish or bearish sentiment.

- Analyzing market intensity: Volume analysis is crucial in conjunction with the Arms Index. If the market is experiencing a significant increase in volume while the Arms Index remains above 1, it could indicate intense selling pressure, potentially signaling a market decline. Conversely, if the market sees high volume along with the Arms Index below 1, it could suggest strong buying activity and a potential market rally.

- Looking for divergences: Divergences between the Arms Index and price movement can provide valuable insights. For example, if the market is making new highs, but the Arms Index is increasing, it may indicate a lack of broad participation, which could be a bearish signal. Similarly, if the market is declining, but the Arms Index is decreasing, it may suggest underlying strength and a potential bullish reversal.

- Confirmation through other technical analysis tools: It is advisable to use the Arms Index in conjunction with other technical analysis tools like trendlines, support and resistance levels, momentum indicators, and moving averages to confirm signals and enhance the accuracy of analysis.

Remember, the Arms Index is just one tool among many in technical analysis, and it should be used in combination with other indicators and tools to make informed trading decisions.