Best Tools for Day Trading to Buy in February 2026

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

-

MASTER TRADE PATTERNS: 20 CHART & 34 CANDLESTICK PATTERNS INCLUDED!

-

ALL SKILL LEVELS WELCOME: PERFECT FOR BEGINNERS & SEASONED PROS!

-

PORTABLE LEARNING: DURABLE CARDS FOR QUICK REFERENCE ON THE GO!

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,X-Large Computer Mouse Pad/Desk Mat with Stitched Edges 31.5 x 11.8 in

-

BOOST TRADING SUCCESS WITH OUR LUCKY STOCK MARKET-INSPIRED DESIGN!

-

ORGANIZED CHARTS AND INDICATORS: PERFECT FOR BEGINNERS AND PROS ALIKE!

-

DURABLE, NON-SLIP SURFACE FOR SEAMLESS TRADING; THE ULTIMATE DESK MAT!

My Trading Journal: Morning Checklist, Logbook and Notes, For stock market, options, forex, crypto and day traders, Bullish Patterns and Indicators

4X Trading Journal for Day Traders | Trade Log Book for Stocks, Forex, Options, Crypto | 12 Week Plan with 80 Trades | Trading Accessories | Neuroscience Based with Guided Trading Plan | Traders Gift

- BOOST TRADING SUCCESS: REFINE STRATEGIES WITH NEUROSCIENCE-BACKED JOURNALS.

- STRUCTURED PLANS FOR RESULTS: CREATE SOLID TRADING PLANS FOR CONSISTENT GAINS.

- TRACK & REVIEW PROGRESS: ANALYZE 80 TRADES TO ENHANCE SKILLS & STRATEGIES.

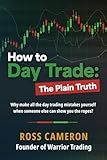

How to Day Trade: The Plain Truth

Options Trading: How to Turn Every Friday into Payday Using Weekly Options! Generate Weekly Income in ALL Markets and Sleep Worry-Free!

Day trading refers to the practice of buying and selling financial instruments within the same trading day, with the goal of making profits from short-term market fluctuations. This type of trading requires active involvement in the markets and it can be quite potentially rewarding, but it also involves risks and requires a certain level of knowledge and discipline. Here are some steps to help you get started with day trading:

- Educate yourself: Before you start day trading, it's important to gain a solid understanding of the financial markets, trading concepts, and strategies. Study resources such as books, online courses, and educational articles to learn about technical analysis, chart patterns, indicators, risk management, and market psychology.

- Set goals and define a strategy: Determine what you want to achieve and set realistic goals for your day trading activities. Focus on a specific market or financial instrument, such as stocks, commodities, or currencies. Develop a trading strategy that aligns with your goals, risk tolerance, and trading style.

- Choose a reliable broker: Selecting a reputable online broker is crucial for day trading success. Look for brokers that offer competitive commissions, a user-friendly trading platform, reliable execution, access to relevant market data, and good customer support.

- Set up a trading account: Open a trading account with your chosen broker and ensure that it provides the necessary features and tools that you need for day trading. This will typically involve providing your personal identification information, completing the required verification processes, and depositing funds into your account.

- Practice with a demo account: Many brokers offer demo accounts that allow you to practice your day trading strategies using virtual money. Utilize this opportunity to test your strategy, practice executing trades, and gain confidence before using real money.

- Develop and test your trading plan: Create a trading plan that outlines your trading rules, including entry and exit points, risk management strategies, and position sizing. Backtest your plan using historical data to verify its effectiveness, and make adjustments as needed.

- Start with small positions: When you are ready to start day trading with real money, begin with small positions to limit your risk exposure while you gain experience. It's important to manage your capital wisely and avoid risking more than you can afford to lose.

- Monitor the markets: Stay informed about market news, economic events, and the performance of the financial instruments you are trading. Utilize real-time market data and charts to identify potential trading opportunities.

- Implement risk management: Establish risk management techniques to protect your trading capital and minimize losses. This may involve setting stop-loss orders to automatically exit losing trades, diversifying your portfolio, and avoiding excessive leverage.

- Continuously learn and adapt: Day trading is a continuous learning process. Stay updated with market trends, learn from your trading experiences - both successful and unsuccessful ones, and be open to adjusting your strategies as needed.

Remember, day trading involves risks, and losses are possible. It's important to approach day trading with a disciplined mindset, practice proper risk management, and be prepared to continually learn and adjust your strategies based on market conditions.

What is level 2 market data and how to analyze it?

Level 2 market data is an advanced type of market data that provides detailed information about the bids and offers for a particular security. It includes the order book, which displays the current prices and quantities of buy and sell orders, as well as the market depth, revealing the number of shares or contracts available at each price level.

Analyzing level 2 market data can provide insights into the supply and demand dynamics for a security and help traders make more informed investment decisions. Here are a few ways to analyze level 2 data:

- Order book analysis: Analyzing the order book involves studying the bid and ask prices, as well as the number of shares or contracts at each price level. Traders can identify key support and resistance levels, gauge market sentiment, and determine potential buying and selling pressure.

- Market depth analysis: Market depth analysis focuses on assessing the liquidity and depth of a market. By analyzing the number of shares or contracts available at various price levels, traders can identify areas of potential buying or selling interest and predict market movements.

- Time and sales analysis: Time and sales, or the ticker tape, displays the time, price, volume, and direction of individual trades. Analyzing this data can provide insights into market trends, such as high-frequency trading activity, large block trades, or unusual price movements.

- Short-term trading strategies: Level 2 data can be utili,zed for short-term trading strategies, such as scalping or momentum trading. Traders can spot price disparities, assess order flow, and execute trades based on the patterns or imbalances observed in the data.

- Assessing market manipulation: Level 2 data can also help identify potential market manipulation, such as spoofing or layering, where traders place large orders to mislead others. By analyzing order book changes and trade activity, suspicious trading patterns can be spotted.

It is worth noting that analyzing level 2 market data is more suitable for active traders or day traders who need real-time information for their trading decisions.

How to manage emotions and stay disciplined while day trading?

Managing emotions and staying disciplined while day trading can be challenging, but here are some strategies that can help:

- Develop a trading plan: Before starting the trading day, create a comprehensive trading plan that includes entry and exit points, risk management strategies, and specific goals. Having a plan in place will provide structure and help you stay focused.

- Set realistic expectations: Understand that day trading involves both wins and losses. Set realistic profit targets and accept that not every trade will be successful. This will help you manage your emotions and avoid impulsive decisions based on greed or fear.

- Use stop-loss orders: Implementing stop-loss orders can help limit potential losses by automatically closing a trade if it reaches a predetermined loss level. This will prevent emotional decision-making when trades are not going as planned.

- Manage position sizing and risk: Determine how much capital you are willing to risk per trade. Avoid taking excessive risks, as this can heighten emotions and lead to impulsive decisions. Using proper position sizing techniques can help you manage risk effectively.

- Practice self-awareness: Recognize and understand your emotions while trading. Be aware of how fear, greed, or frustration might impact your decision-making. If you notice overwhelming emotions, take a step back and reevaluate your trading strategy.

- Take breaks and avoid overtrading: Situations of high emotional intensity can lead to poor decision-making. Taking regular breaks during the trading day can help you clear your mind, regain focus, and prevent impulsive trading actions.

- Keep a trading journal: Maintaining a trading journal helps you evaluate your trading decisions, learn from your mistakes, and track your progress over time. It can provide insights into your emotional patterns and help you identify areas for improvement.

- Practice mindfulness and stress management techniques: Incorporate stress management practices such as deep breathing, meditation, or exercise into your trading routine. These techniques can help you stay calm and focused during intense trading situations.

Remember, managing emotions and staying disciplined in day trading is an ongoing process. It takes time, practice, and consistent adherence to your trading plan and risk management strategies.

What is the impact of margin requirements on day trading?

Margin requirements have a significant impact on day trading. Margin is essentially a loan provided by a broker that allows traders to leverage their positions and trade with borrowed funds. Day traders often utilize margin to amplify their potential returns.

- Increased Trading Power: Margin allows day traders to control larger positions with a smaller amount of capital. With higher leverage, they can take on larger trades and potentially profit more from small price movements in the market.

- Higher Potential Returns: Using margin effectively can enhance a day trader's profit potential. By borrowing funds to increase their buying power, day traders can amplify their gains if the trade goes in their favor.

- Increased Risk: While margin can increase the potential for profits, it also significantly elevates the risk. Higher leverage means larger losses if the trade does not work out as expected. Day traders must be cautious as the use of margin presents a greater chance of incurring significant losses, potentially wiping out their account.

- Margin Calls: Margin requirements dictate the amount of equity a trader must maintain in their account relative to the borrowed funds. If the account value falls below the required level, a margin call is triggered, requiring the trader to deposit additional funds or potentially be forced to close their positions. This can lead to liquidation at disadvantageous prices, resulting in substantial losses.

- Volatility and Short-Term Trading: Day traders often focus on short-term trades and capitalize on market volatility. Margin requirements support this strategy by allowing traders to take multiple trades in a single day, enabling them to capture potential price movements and profit from short-term market fluctuations.

In summary, margin requirements have a significant impact on day trading by providing increased trading power, profit potential, and the ability to take advantage of short-term market movements. However, it also increases risk exposure and the likelihood of significant losses. Day traders need to carefully manage their margin levels and consider the potential impact on their trading strategy and overall profitability.

How to analyze and trade options in day trading?

Analyzing and trading options in day trading requires a thorough understanding of the options market, technical analysis techniques, and risk management strategies. Here are steps to follow:

- Understand options: Learn the basics of options trading, including the terminology, types of options (call and put options), expiration dates, strike prices, and pricing models. Also, understand the factors that influence option prices, such as the underlying asset's price, volatility, time to expiration, and interest rates.

- Research and select an underlying asset: Identify the stocks, ETFs, or indices that you want to trade options on. Conduct fundamental and technical analysis to assess the market conditions, trends, and potential price movements.

- Identify trading opportunities: Use technical analysis tools like charts, indicators, and patterns to identify potential entry and exit points. Look for options with high liquidity, tight bid-ask spreads, and suitable strike prices for your trading strategy.

- Develop a trading plan: Determine your risk tolerance, profit targets, and stop-loss levels before initiating any trade. Consider position sizing based on your account size and risk management rules.

- Execute the trade: Place your options trade through a reliable brokerage platform that can provide real-time market data and order execution capabilities. Choose the appropriate options strategy based on your analysis, such as buying calls or puts, selling options, or engaging in more complex strategies like spreads or straddles.

- Monitor the trade: Continuously track the progress of your trade, keeping an eye on the underlying asset's price movements, volatility, and any relevant news or events that could impact your options position.

- Manage risk: Set stop-loss orders or use trailing stop-loss orders to protect your position in case the trade goes against you. Consider using options Greeks (delta, gamma, theta, vega) to manage and hedge your risk exposure.

- Monitor option liquidity: Ensure that there is sufficient trading volume and liquidity in the options contracts you are trading. Illiquid options may have wider bid-ask spreads and may be harder to exit at desired prices.

- Constantly learn and adapt: Stay updated with market news, economic indicators, and any changes in options regulations. Continuously improve your trading skills and strategies through reading books, attending webinars, or following experienced traders' insights.

Remember, options trading carries significant risks, including a potential loss of your entire investment. It is essential to educate yourself, practice with virtual accounts, and start with small positions while gaining experience and confidence in option trading.