Best ROC Trading Books to Buy in February 2026

Grave Peril (The Dresden Files, Book 3)

The Last Battle: Dragonmaster, Book Three (The Dragonmaster Trilogy)

Host (Thorn St. Croix, Book 3)

The Nations of the Night: Book Two of the Lightbringer Trilogy

The Forging of the Shadows: Book One of The Lightbringer Trilogy

Storm Front (The Dresden Files, Book 1)

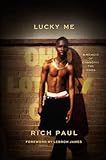

Lucky Me: A Memoir of Changing the Odds

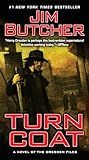

Turn Coat (The Dresden Files, Book 11)

The Rate of Change (ROC) indicator is a momentum oscillator that measures the percentage change in price over a specified time period. It helps traders identify the speed at which prices are changing and assess the strength of a trend.

To apply the ROC indicator in trading, you can follow these steps:

- Calculation: ROC is calculated by taking the current price and subtracting the price from a specified number of periods ago. The difference is then divided by the price from that earlier period and multiplied by 100 to get the percentage change.

- Setting the period: Determine the number of periods you want to use for the calculation. It can be based on your trading strategy or preference. Commonly used periods are 9, 12, or 14.

- Interpretation: Positive values of ROC indicate an upward momentum or bullish trend, while negative values indicate a downward momentum or bearish trend. The magnitude of the value indicates the strength of the momentum.

- Signals: Traders often use the ROC indicator to generate buy and sell signals. These signals can be derived from crossovers, divergences, or reaching certain threshold values. Crossovers: When the ROC line crosses above the zero line, it is considered a buy signal, indicating upward momentum. Conversely, when it crosses below the zero line, it is a sell signal, suggesting downward momentum. Divergences: Traders also look for divergences between the ROC indicator and the price chart. If the price is making higher highs while the ROC is making lower highs, it could be a bearish divergence, indicating a potential reversal. Conversely, if the price is making lower lows, and the ROC is making higher lows, it could be a bullish divergence, suggesting a potential upward reversal. Threshold values: Some traders use specific threshold values to generate signals. For example, if the ROC exceeds a certain threshold (e.g., 5 or 10), it could be considered a buy signal. Alternatively, if it falls below a preset value, it could indicate a sell signal.

- Confirm with other indicators: While ROC can provide valuable insight into market momentum, it is generally best to confirm signals with other technical indicators or chart patterns to reduce the chances of false signals.

Remember that the ROC indicator should not be used in isolation but rather as part of a comprehensive trading strategy. It is recommended to practice using the indicator on historical price data or in a demo trading environment before integrating it into live trading.

What are the advantages of using the ROC indicator over other indicators?

The ROC (Rate of Change) indicator offers several advantages over other indicators, including:

- Simplicity: The ROC indicator is relatively simple and easy to understand and calculate. It measures the percentage change in price over a specific period, providing a clear and straightforward indication of price momentum.

- Versatility: ROC can be applied to various asset classes and timeframes, including stocks, commodities, and currencies. It can be used for short-term trading or longer-term analysis, making it adaptable to different trading strategies and investment styles.

- Non-directional: Unlike many other indicators that generate buy or sell signals based on moving averages or other criteria, ROC is a non-directional indicator. It measures the strength of price momentum, irrespective of price direction, allowing traders to identify potential trend reversals or confirm the strength of an ongoing trend.

- Effective for identifying overbought or oversold conditions: ROC can serve as an effective tool for identifying overbought or oversold market conditions. When the ROC value reaches extreme levels, it suggests that the price has moved too far and is due for a correction. Traders can use this signal to potentially enter or exit trades, increasing the probability of profitable trades.

- Confirmation of price trends: Traders often use ROC in conjunction with other technical indicators to confirm price trends. When the ROC indicator shows a significant positive or negative slope in the same direction as the price trend, it indicates a strong and sustainable trend.

- Leading indicator: ROC is a leading indicator as it provides early signals of potential trend changes. By measuring the speed of price movements, it can help identify potential reversals or trend shifts before they become evident on the price chart.

- Divergence detection: ROC can detect divergences between price and momentum. When price makes new highs or lows, but the ROC fails to confirm the move, it signals a potential weakening or exhaustion of the trend. This divergence can help traders anticipate trend reversals or corrections.

It is important to note that while ROC offers various advantages, no single indicator guarantees successful trading outcomes. Traders should use ROC in conjunction with other technical analysis tools and consider other market factors before making trading decisions.

How does the ROC indicator compare to other momentum indicators?

The ROC (Rate of Change) indicator measures the speed or rate at which a stock price or any other financial instrument changes over a specified period of time. It is a momentum oscillator that shows the percentage change in price from one period to another.

When comparing the ROC indicator to other momentum indicators, some key points to consider are:

- Calculation methodology: The ROC calculates the velocity of price change by comparing the current price to the price "n" periods ago. Other momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) have different calculation methodologies, providing alternative perspectives on momentum.

- Scale and interpretation: The ROC is displayed as a percentage, reflecting the percentage change in price over time. This allows for easy comparison across different instruments and timeframes. Other momentum indicators may have different scales or ranges, requiring a slightly different interpretation.

- Sensitivity to price changes: The ROC is sensitive to even small price movements as it directly measures the rate of change. This can make it more responsive to short-term price fluctuations. On the other hand, indicators like the MACD may smooth out minor price movements and be more suitable for identifying longer-term trends.

- Divergence signals: Like other momentum indicators, the ROC can exhibit bullish or bearish divergence signals. Bullish divergence occurs when the price makes lower lows while the ROC makes higher lows, suggesting a potential trend reversal to the upside. Bearish divergence occurs when the price makes higher highs while the ROC makes lower highs, indicating a potential trend reversal to the downside.

- Timeframe suitability: The ROC indicator can be applied to various timeframes but is often used for shorter-term analysis due to its sensitivity to price changes. Other momentum indicators like the Moving Average Convergence Divergence Histogram (MACD-H) or Moving Average (MA) crossovers may be more suitable for longer-term trend identification.

Ultimately, the choice of momentum indicator depends on the trader's preference, trading style, and the specific requirements of the analysis. Traders often combine multiple indicators to gain a comprehensive view of momentum and make informed trading decisions.

How to use the ROC indicator in conjunction with moving averages?

The ROC (Rate of Change) indicator is a momentum oscillator that compares the current price level to a previous price level over a specified period. It measures the speed at which the price is changing and helps identify overbought and oversold conditions.

When using the ROC indicator in conjunction with moving averages, you can benefit from the combined insights provided by these two technical indicators. Here are three common approaches:

- ROC and Moving Average Crossovers:

- Choose a suitable moving average, such as the simple moving average (SMA) or exponential moving average (EMA), based on your trading strategy and time frame.

- Plot the moving average on your price chart.

- Overlay the ROC indicator below the price chart.

- Look for crossovers between the ROC line and the moving average line. When the ROC line crosses above the moving average line, it may indicate a bullish signal. Consider buying or exiting short positions. When the ROC line crosses below the moving average line, it may indicate a bearish signal. Consider selling or exiting long positions.

- ROC Divergence from Moving Average:

- Apply a moving average to the ROC line itself.

- Observe the divergence between the ROC line and its moving average. If the ROC line rises above its moving average, it suggests increasing bullish momentum. If the ROC line falls below its moving average, it suggests increasing bearish momentum.

- Consider entering or exiting positions based on the direction and size of the divergence.

- Confirmation using Multiple Moving Averages:

- Use two or more different moving averages, such as a shorter-term and a longer-term moving average, to confirm signals from the ROC indicator.

- For example, if the ROC line crosses above the short-term moving average and the moving averages are also in a bullish position (shorter-term moving average above longer-term moving average), it adds more weight to the bullish signal.

- Conversely, if the ROC line crosses below the short-term moving average and the moving averages are also in a bearish position, it strengthens the bearish signal.

Remember, the ROC indicator is just one tool among many. It is essential to combine it with other indicators, perform thorough analysis, and incorporate risk management strategies for successful trading decisions.

What are the limitations of using the ROC indicator in trading?

The ROC (Rate of Change) indicator is a commonly used technical analysis tool in trading. While it can provide valuable insights into price momentum, it has certain limitations that traders should be aware of:

- Lagging indicator: The ROC indicator is based on past price data, which means it is a lagging indicator. It does not provide real-time information about the market and can be slow in capturing sudden price changes or reversals.

- Sensitivity to market noise: The ROC indicator can be highly sensitive to market noise or short-term price fluctuations. As a result, it can generate false signals or whipsaws during volatile or sideways market conditions.

- Lack of trend identification: ROC is primarily focused on measuring momentum and does not provide clear signals about the direction of the trend. Traders need to use additional indicators or tools to confirm the presence of a trend before relying solely on ROC signals.

- No absolute value interpretation: The ROC value is represented as a percentage change, which makes its interpretation different for different securities or price levels. Comparing ROC values across different stocks or assets without adjusting for their price disparities can be misleading.

- No information on price levels: ROC only provides information on the change in price momentum, not the actual price levels. It may fail to identify potential support or resistance levels, which are crucial for traders to make informed decisions.

- Overbought and oversold signals: ROC is often used to identify overbought or oversold conditions. However, it can give false signals in trending markets, as prices can stay overbought or oversold for extended periods during strong trends.

- Lack of well-defined trading rules: ROC does not have well-defined rules for trade entry or exit. Traders often use it in conjunction with other indicators or technical analysis tools to build a comprehensive trading strategy.

It is important for traders to understand the limitations of any technical analysis tool, including the ROC indicator, and consider them in the context of their overall trading approach.

What are some practical examples of applying the ROC indicator in trading?

- Identifying Entry and Exit Points: Traders can use the ROC indicator to identify potential entry and exit points. For example, if the ROC indicator shows a strong positive momentum, it suggests that the price may continue to rise, signaling a potential buying opportunity. Conversely, a strong negative momentum could indicate a potential sell signal.

- Divergence Trading: ROC can also be useful in identifying divergence between price and momentum. For instance, if the price is making higher highs while the ROC is making lower highs, it suggests that the upward momentum is weakening, indicating a potential reversal in the price trend.

- Overbought and Oversold Conditions: ROC can help traders identify overbought and oversold conditions in the market. Traders can look for extreme readings in the indicator to indicate potential price reversals. For example, if the ROC indicator shows an extremely high positive value, it could indicate that the asset is overbought and due for a pullback.

- Confirmation of Breakouts: When a security breaks out of a range, traders can use the ROC indicator to confirm the strength of the breakout. If the ROC indicator shows a significant increase, it adds confidence to the breakout signal, indicating a potential continuation of the price move.

- Trend Reversal Confirmation: ROC can also be used to confirm trend reversals. When the ROC indicator changes its direction after a prolonged trend, it suggests a potential trend reversal. Traders can use this signal to adjust their positions or enter new trades.

It's important to note that while the ROC indicator provides valuable insights, it should be used in combination with other technical analysis tools and indicators for more accurate trading decisions.

What are the common settings for the ROC indicator?

The ROC indicator, short for Rate of Change, measures the percentage change in price over a specific period of time. The common settings for the ROC indicator are as follows:

- Period: This refers to the number of periods or time intervals the indicator considers. Typical periods used range from 7 to 21.

- Price type: ROC can be calculated based on different price types, such as closing price, high price, low price, or even average price. Most commonly, it is calculated using the closing price.

- Lookback period: Some versions of the ROC indicator include a lookback period that compares the current rate of change to its past levels. This period can be set as desired, with 14 being a commonly used value.

It's important to note that these settings may vary depending on the preferences of individual traders or the specific trading strategy being employed.